Amazing Info About Zero Budget Spreadsheet

It doesn’t allow for individual transactions, but simply being able to monitor your progress against your plan is helpful.

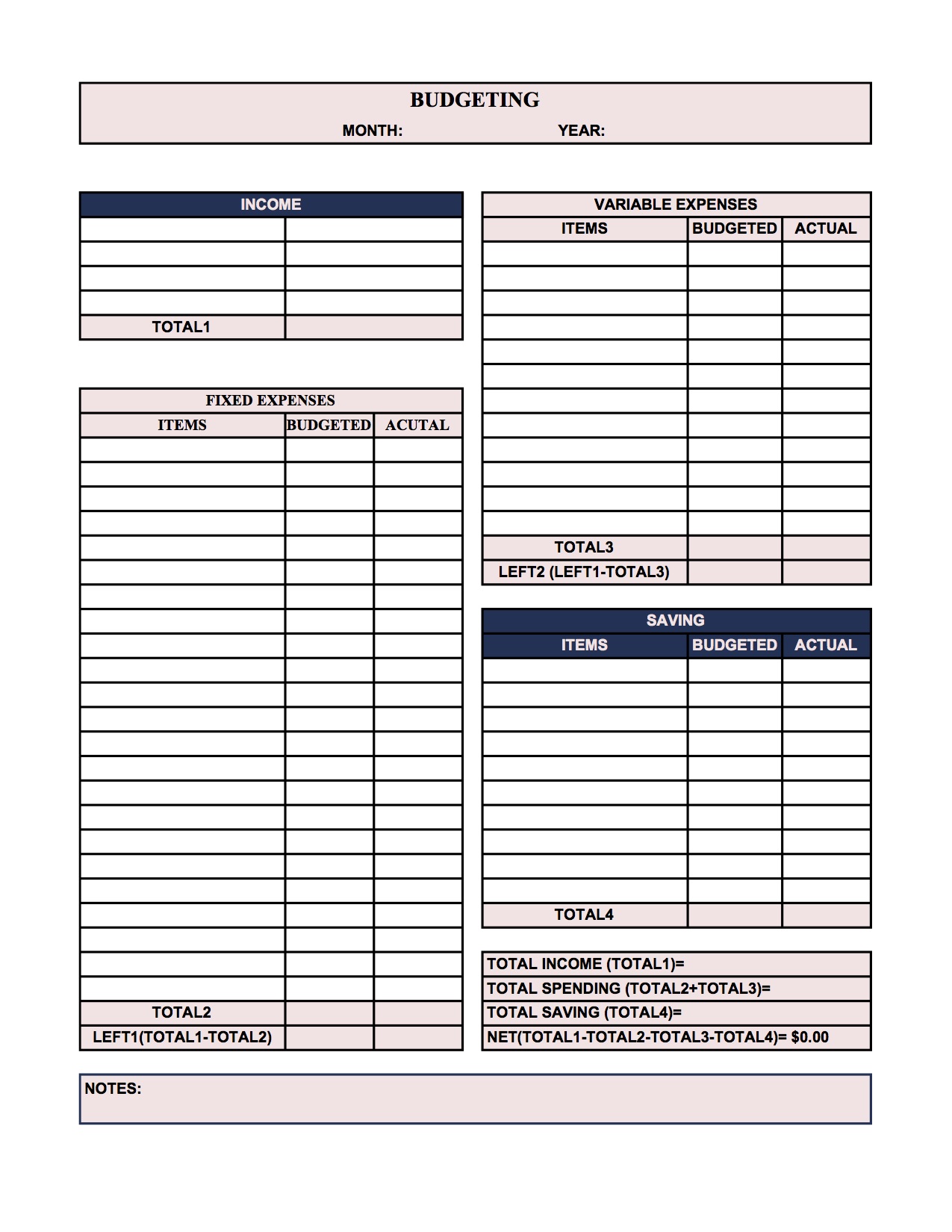

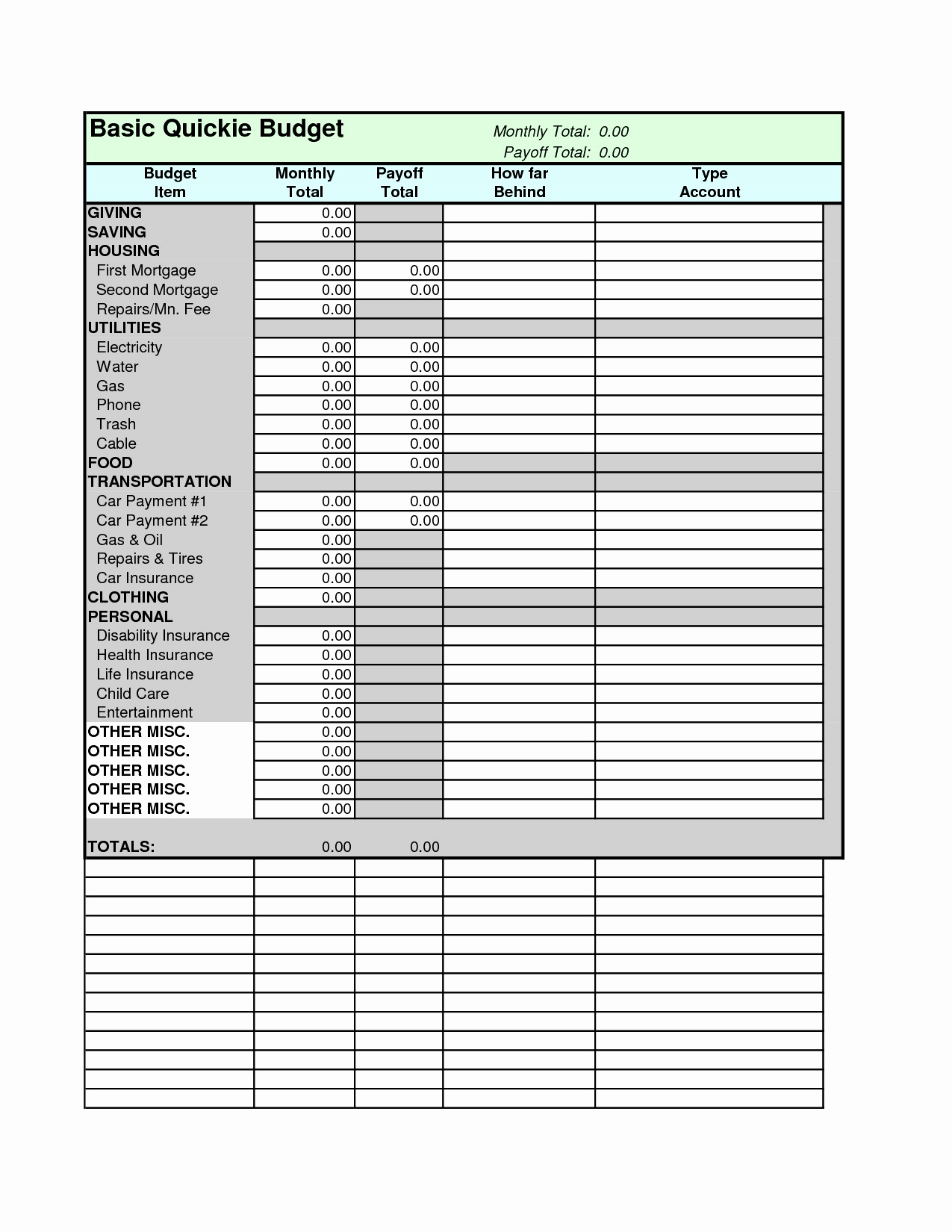

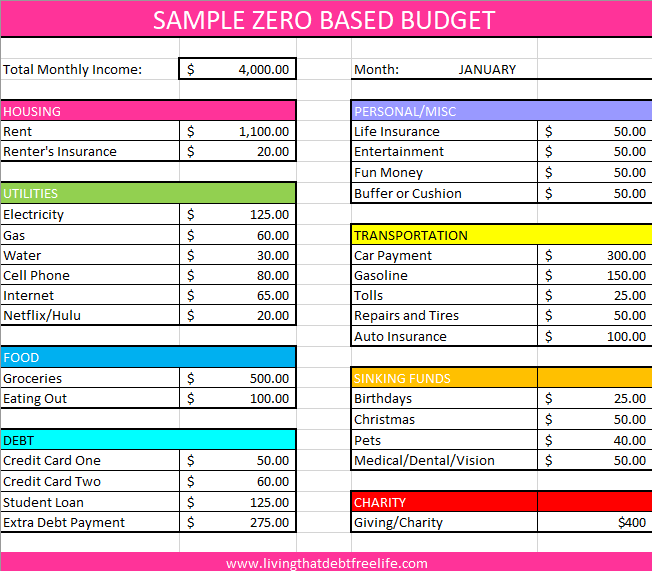

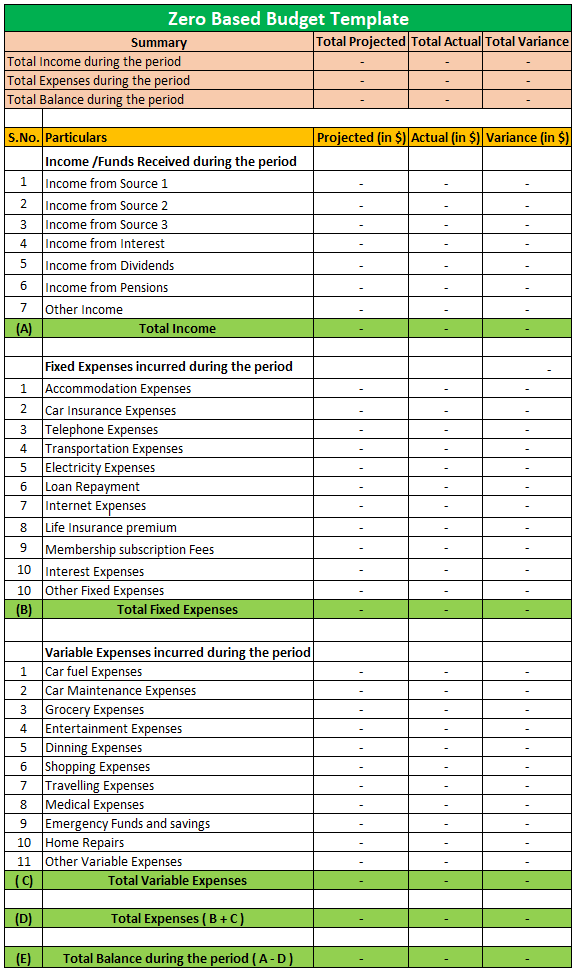

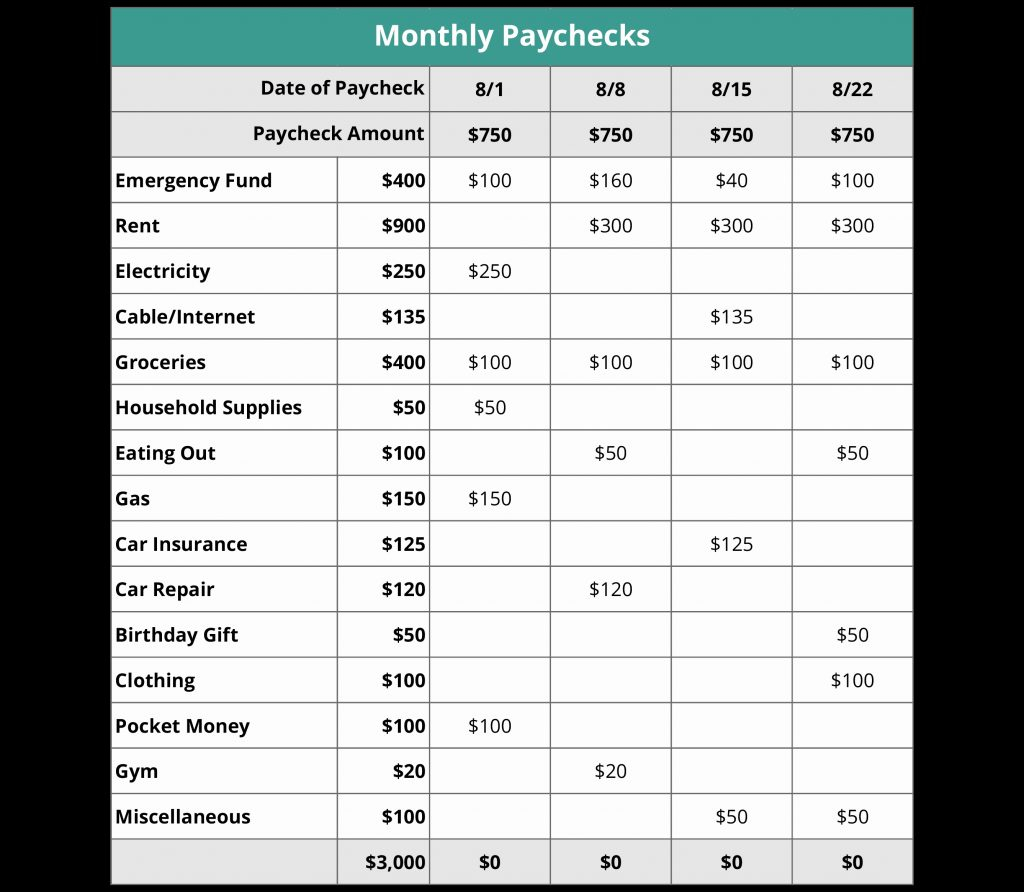

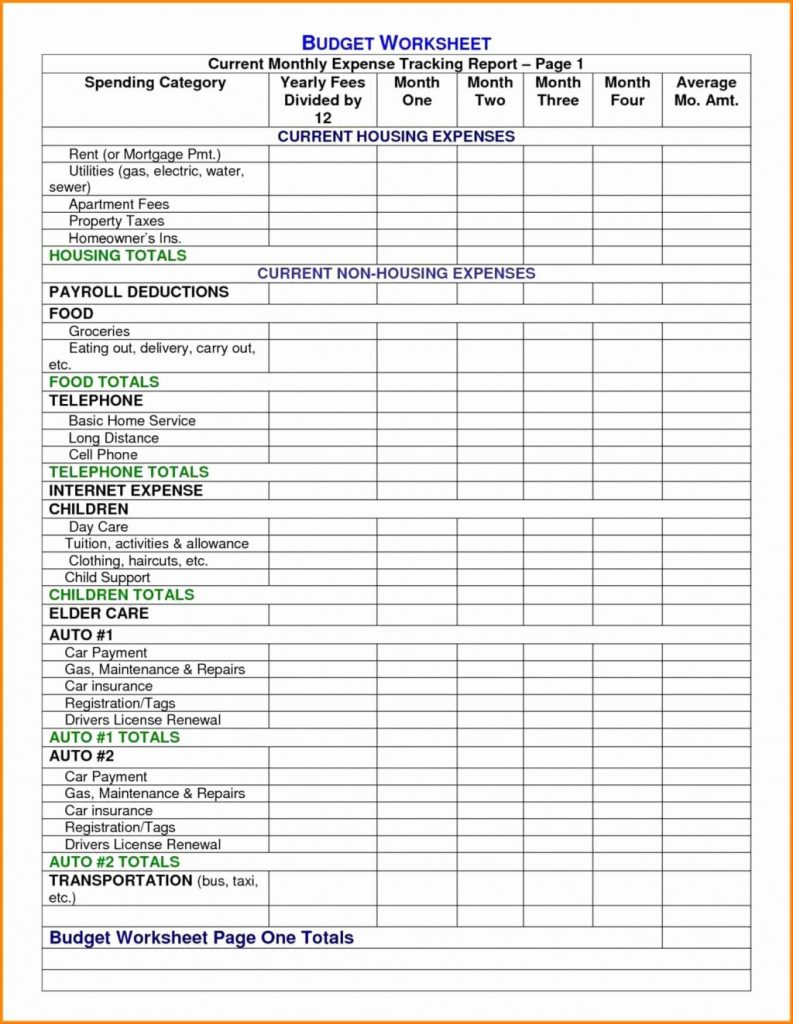

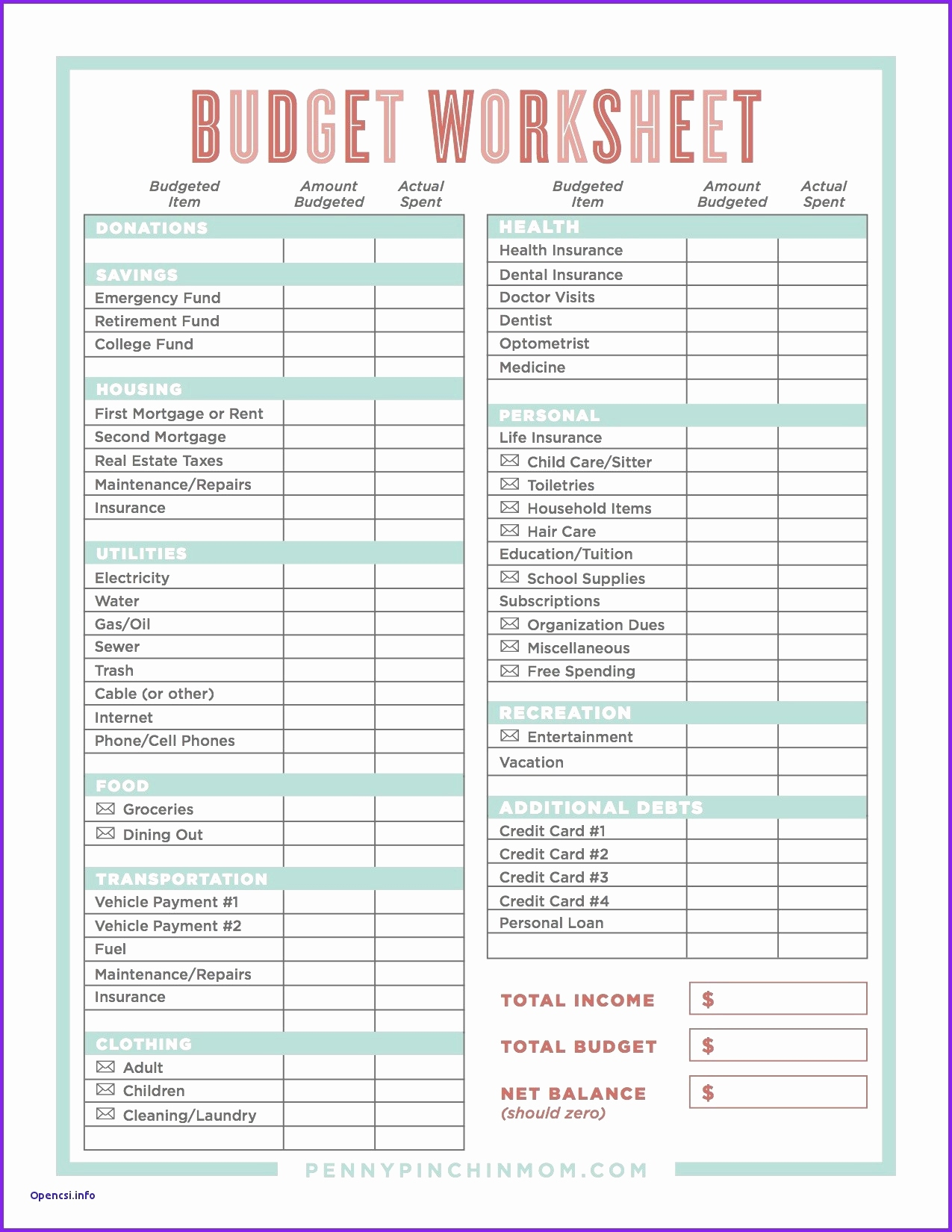

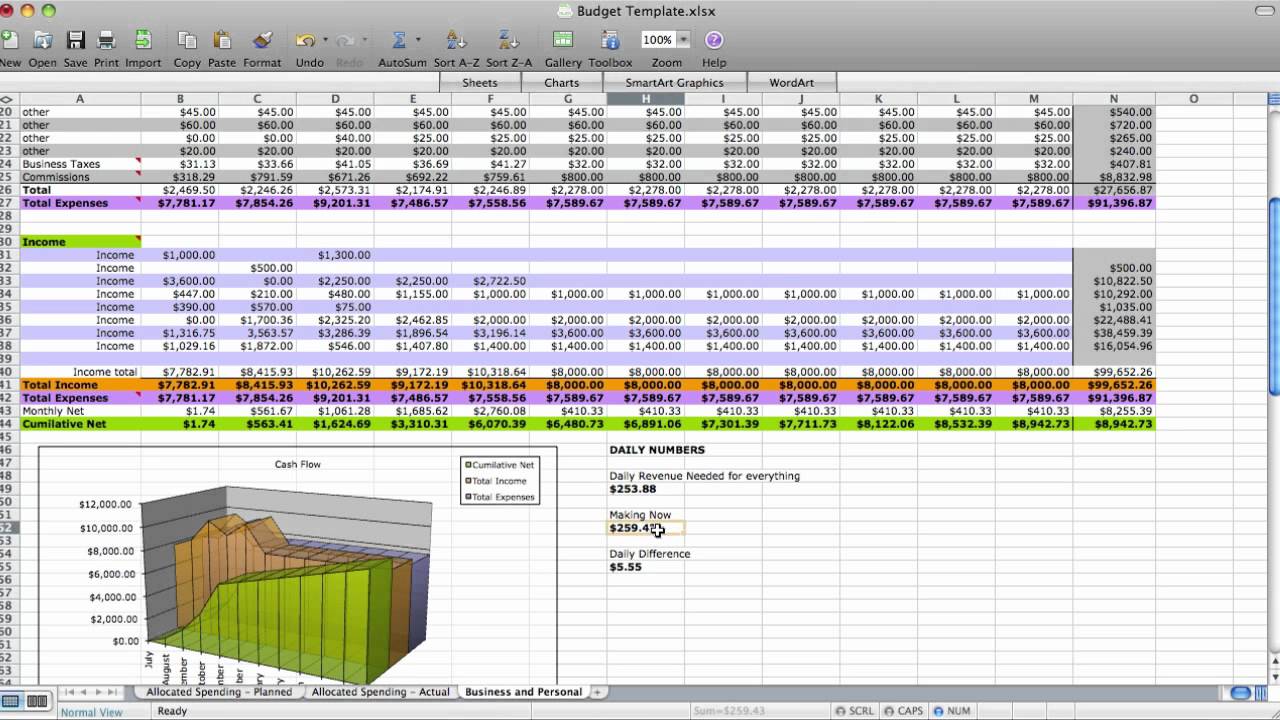

Zero budget spreadsheet. Calculate your monthly income 2. Budgeting really is the first step to financial freedom. So, when you add up all of your income and then subtract all.

Typically this means you will make a plan for every dollar you earn. Or sign in to microsoft and edit in your desktop browser. The basic idea with a zero based budget is to give every dollar you make a job or responsibility.

Open google drive and click on the apps icon. You can change expense categories and amounts every month. Visit templates.office.com and type “budgets” in the search box to find an excel file to download.

Where to get it: You can update your income in the spreadsheet as your circumstances change. On the google sheets homepage, click on blank spreadsheet to create a new spreadsheet from scratch.

The zbb differs from the conventional or incremental budgeting system since it. It is a saving and spending plan where you assign every dollar of your income to some specific purpose. Every dollar is given an assignment, so you know exactly where your money is going.

Free excel budget templates for 2023 1. Receive automated budget and spend approval requests. What is zero based budgeting?

Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. Designed by cory hopper. The goal is that your monthly income minus expenses equals zero by the end of the month.

If you have a good budget in all. Track monthly actuals against budget goals by department. This set of templates in smartsheet helps track monthly actuals against budget goals so you can tightly manage your financial performance and ensure your business stay on track.

Some of your income will be going into savings, some will be going towards expenses, some might. From the applications, select sheets to open the google sheets console. Your income minus your expenditures should equal zero.

Make a plan for leftover money 4. Determine your monthly expenses 3. At the end of the worksheet, if your budget is fully balanced, you should have zero budget left over.

![Download [Free] ZeroBased Budgeting Excel Format](https://i0.wp.com/exceldownloads.com/wp-content/uploads/2021/07/Zero-Based-Budget-Worksheet-Template-_Feature-Image.png?w=589&ssl=1)